Japan Last reviewed 08 August 2022 45 plus 21 surtax. Corporate income taxsolidarity surcharge.

10 Things To Know For Filing Income Tax In 2019 Mypf My

The individual income tax rate in Japan is progressive and ranges from 5 to 45 depending on your income for residents while non-residents are taxed at a flat rate of around 20.

. Income tax payable if your income exceeds 25 lacs annually. Note that if you work for a Thai company with an International Business Center IBC status have a tax-residency status in Thailand make a. Jersey Channel Islands Last reviewed 22 July 2022 20.

Malaysia Maldives Republic of Malta Mauritania Mauritius Mexico. This 24-unit program with full- and part-time enrollment options features 14 units of core coursework and 10 units of specialized electives. Do i declare in Malaysia in which may required to pay tax in malaysia.

This income tax calculator can help estimate your average income tax rate and your take home pay. Important Terms and Definitions under The Income Tax Act 1961 Assessment year and previous year As per Section 29 of the Income Tax Act 1961 states that assessment year means the 12 month period beginning on the 1st day of April every year. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Jamaica Last reviewed 08 September 2022 25. On average high-income countries have tax revenue as a percentage of GDP of around 22 compared to 18 in middle-income countries and 14 in low-income countries. Find out how much Thailand income tax youll pay when working or retiring here and the deductions and allowances you can claim back.

How many income tax brackets are there in Japan. The main source of personal income tax for expats in Thailand is through employment. From 875 to 203 depending upon the location of the business establishment.

The same taxation slabs apply to the freelancing individuals as well. Kazakhstan Last reviewed 01. The assessee is required to file the income tax return of the previous year in the assessment year.

May 02 2019 at 238 pm. As you mightve noticed tax rates are comparable to most other countries so the assumption that Thailand is a tax haven is untrue. The color key is based on CIT rate percentage.

The freelance calculate income tax shows the values as per these tax rates only. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment.

See Ivory Coasts individual tax summary for salary tax national contribution and general income tax rates. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Also learn income tax slab rates in FY 2016-17.

What are the Income Tax Taxation Slabs. Average personal income tax and social security contribution rates on gross labour income Table I6. Clicking a region will then allow you to hover over andor click a territory.

In high-income countries the highest tax-to-GDP ratio is in Denmark at 47 and the lowest is in Kuwait at 08 reflecting low taxes from strong oil revenues. Incomes up to Rs 25 lakhs are not taxed upon income between the values 25 lakhs to 5 lakhs are taxed 10 5 to 10 lakhs 20 and above 10 lakhs 30. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

All-in average personal income tax rates at average wage by family type. Know all about Income Tax in India types of direct indirect taxes. Unlike other tax law programs our core courses provide you with a robust foundation of practical skills in.

Jordan Last reviewed 30 June 2022 30. 1 This Act may be cited as the Income Tax Act 1967.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

7 Tips To File Malaysian Income Tax For Beginners

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

How To Calculate Foreigner S Income Tax In China China Admissions

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

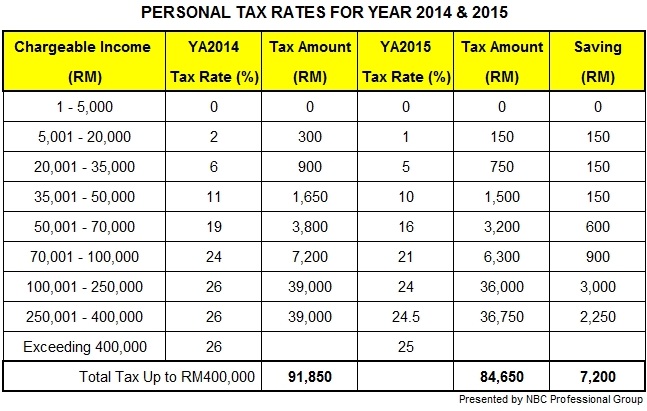

Budget 2015 New Personal Tax Rates For Individuals Ya2015 Tax Updates Budget Business News

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Malaysian Personal Income Tax Pit 1 Asean Business News

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Budget 2021 Personal Income Tax Goodies

Individual Income Tax In Malaysia For Expatriates

Tiffin Sentul Depot Satisfy Your Seafood Cravings At The Big Feast By Tiffin At The Yard

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook